Principles of Microeconomics

2023-03-23

MIT OCW 14.01SC - Summary

MIT 14.01SC - Principles of Microeconomics (Youtube Playlist)

L1. - Introduction to Microeconomics

- Economics is about scarcity and resource optimisation.

- Microeconomics tries to model a general decision making framework.

- We look at behaviour of two main actors in Microeconomics: Producers and Consumers.

- One key variable: Prices. Prices determine resource production, consumption and allocation.

- Positive vs Normative economics: How things are? vs How things should be?

L2. - Application of Supply and Demand

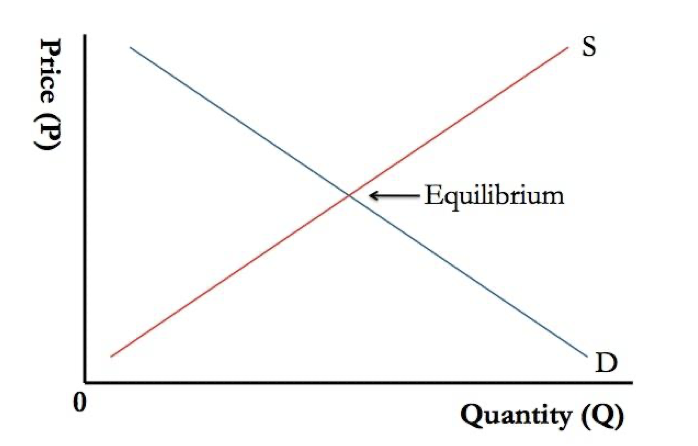

- Supply and Demand curves. Equilibrium point at intersection.

Q_d = D(P)dQ_d / dP < 0(Law of Demand)Q_s = S(P)dQ_s / dP > 0(Law of Supply)Q_d (P*) = Q_s (P*)P*is optimal price.

- Supply and Demand curve shifts due to shocks

- Market absorbs excess supply and excess demand by shifting equilibrium.

- Price changes in one market can affect another.

- General equilibrium includes feedback effects.

- Government Intervention in Markets.

- Eg. Minimum wage, Price ceilings.

- May cause inefficiences, e.g. unemployment, shortages.

- Equity-Efficiency tradeoffs.

- Costs:

- Efficiency loss - trade that could make both parties better off is not made.

- Allocation inefficiency - resources are not allocated to those who need them the most.

- Benefit:

- Equity - (percieved?) fairness.

- Costs:

- Direct effects (what voters see) and indirect effects (what economists see).

- Secondary markets can arise to evade government regulation.

L3. - Elasticity

Elasiticity of demand (\epsilon_d) = (dQ/Q)/(dP/P) = (dQ/dP)*(P/Q). (units: dimensionless, ratio of %s) (should be negative) (percent change in qty / percent change in price)- Perfectly Inelastic Demand:

elasticity = 0. - Perfectly Elastic Demand:

elasticity = -infinite.

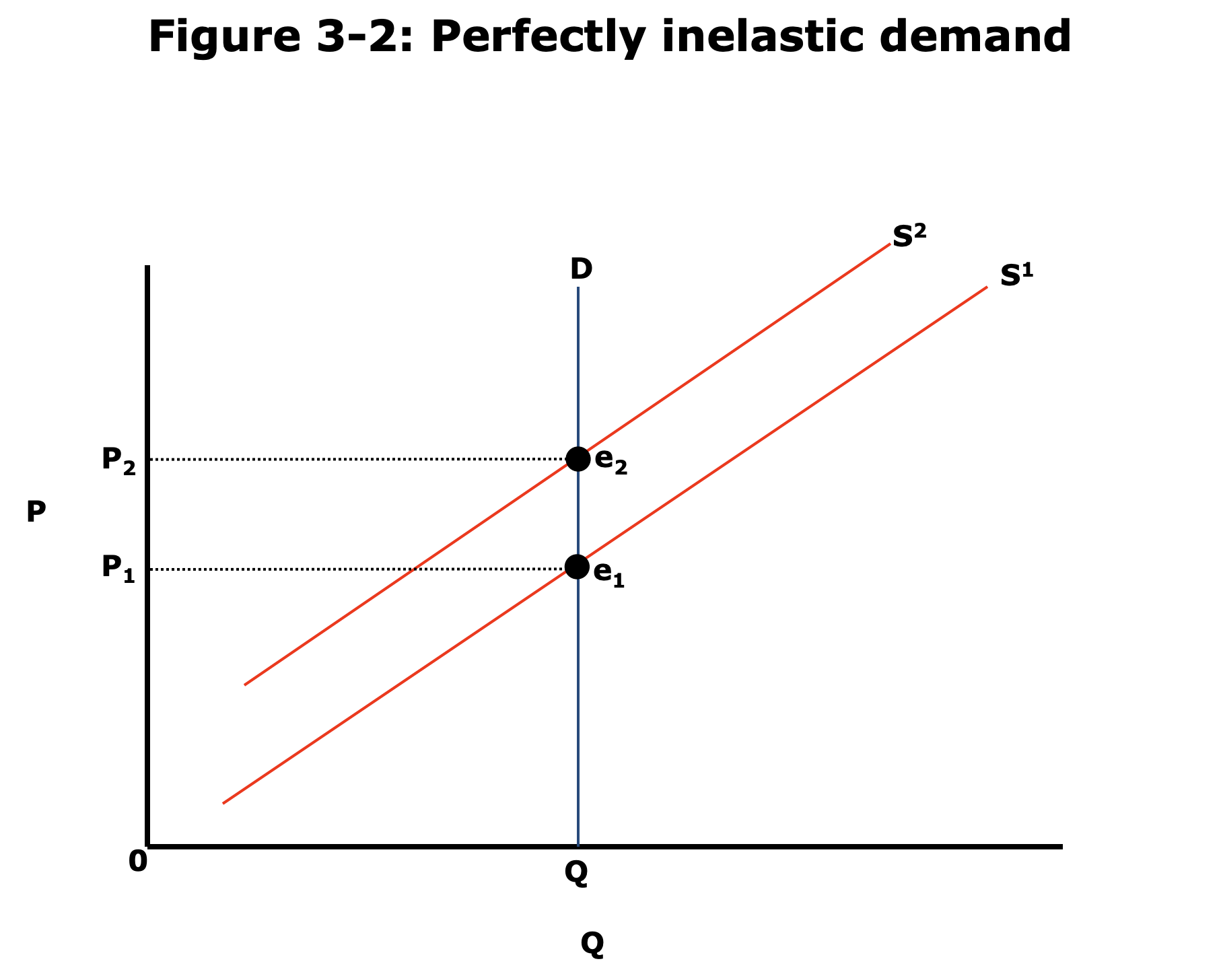

- Perfectly Inelastic Demand:

- Perfectly Inelastic Demand

- Demand does not change with price change

- Straight vertical line on price-qty diagram.

- Example: when there are no substitutes.

- Some Medicine / treatments - e.g. insulin for diabetics.

- Example of elastic demand: viagra.

- What happens in case of supply shock?

- If supply decreases(?) There cannot be excess demand. The price increases. No change in qty.

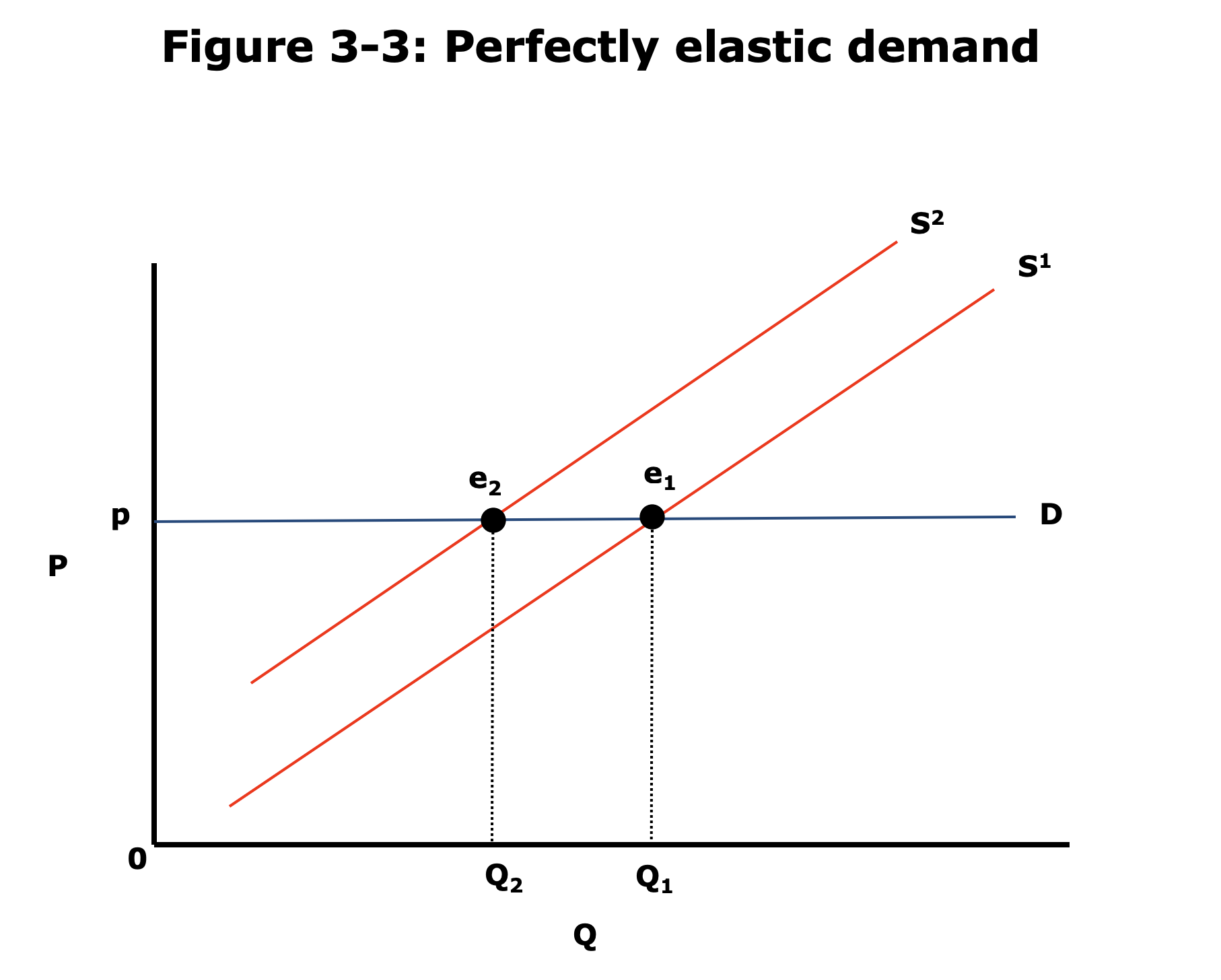

- Perfectly Elastic Demand.

- Straight horizontal line on price-qty diagram.

- Where consumers don't care about quantity, but only about price.

- Example: There are infinitely good substitutes.

- E.g. Candy. Orbit and Eclipse. McDonalds and Burger King.

- If price of Orbit increases people would buy Eclipse.

- If there is a supply shock, price could not change, only qty supplied would change.

- Straight horizontal line on price-qty diagram.

- Peek ahead about Producer theory:

- Revenue

R = Q * P(unit: $) (dR/R)/(dP/P) = (dR/dP) * (P/R) = Q(1+E)*P/R = (1+E)- If

Elasticity > -1, producer benefits by raising price.- But then why isn't price always 0 or infinity? coming up next lectures.

- Revenue

- Difficult to measure elasticities because of causation/correlation problem.

- However, this data may be important to determine govt. policies.

L4. - Preferences and Utility

- We assume all consumer behaviour comes from Utility Maximisation.

- Three steps:

- Assumptions:

- Completeness: Can always pick which one I like more between A & B.

- Transitivity: If A > B, B > C then A > C.

- Non-Satiation: More is always better!

- Utility Functions.

- Budget constraints.

- Assumptions:

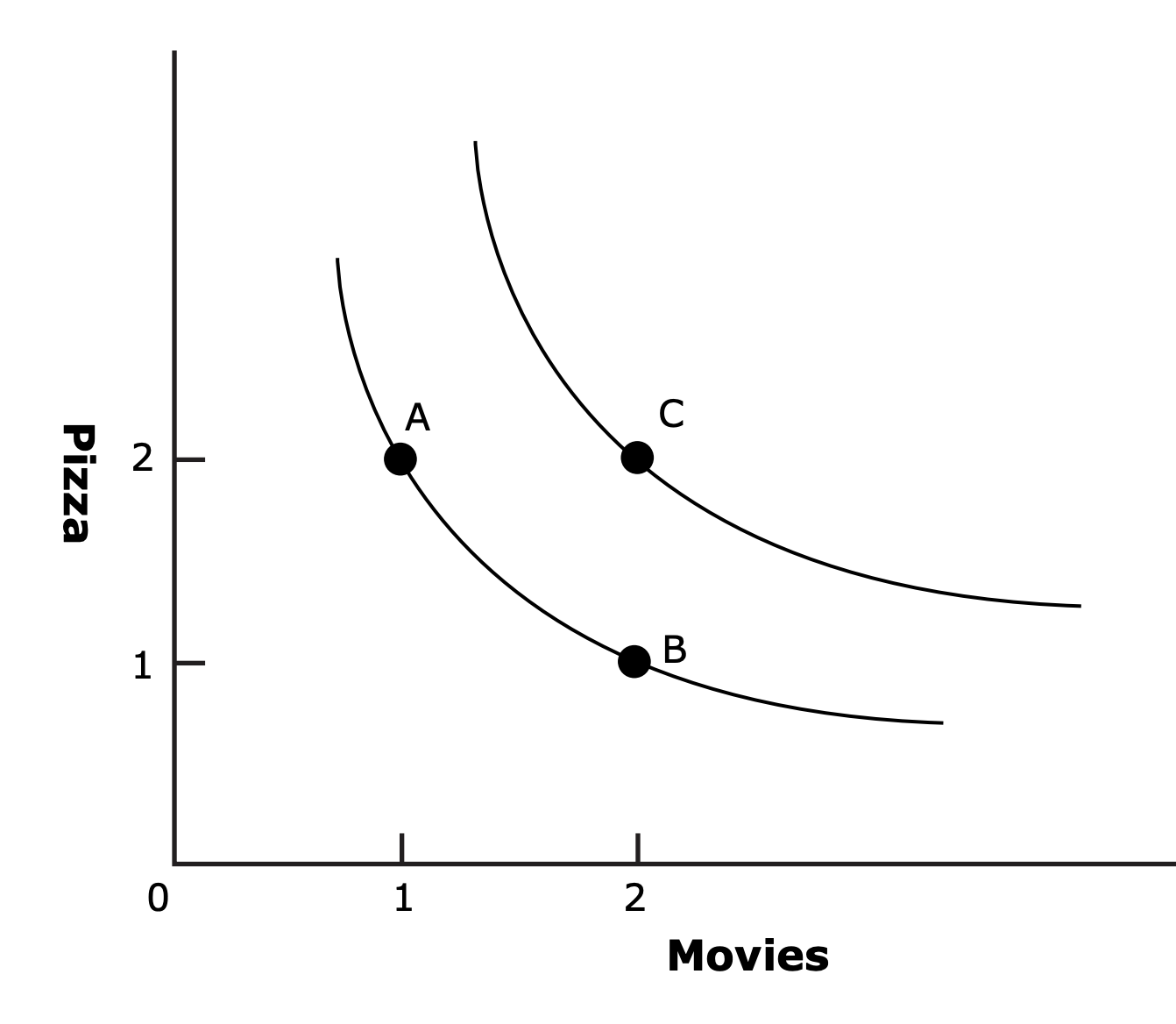

- Indifference curves:

- Utility: Mathematical representation of preferences.

U(x, y)=> value doesn't mean anything, only relative ranking does.- We assume

d^2 U/d(X^2) <= 0(diminishing marginal utility)

- Link between Utility and Preference maps?

- Marginal rate of substitution.

U(x, y) = 0=>∂U/∂x dx + ∂U/∂y dy = 0=>dy/dx = -(∂U/∂x)/(∂U/∂y)- We always have diminishing marginal rate of substitution.

- Marginal rate of substitution.

L5. - Budget Constraints

- Assuming for now that income = budget. (No savings.)

- Good enough assumption for typical Americans.

- Budget constraint: Straight line on graph (

y = Sum (P_i * X_i)) - Slope of the line will be (-ve of price ratio) (

-P_1/P_2)- This slope is called Marginal Rate of Transformation

- Opportunity Cost

- Oppertunity cost is the value of the forgone alternative.

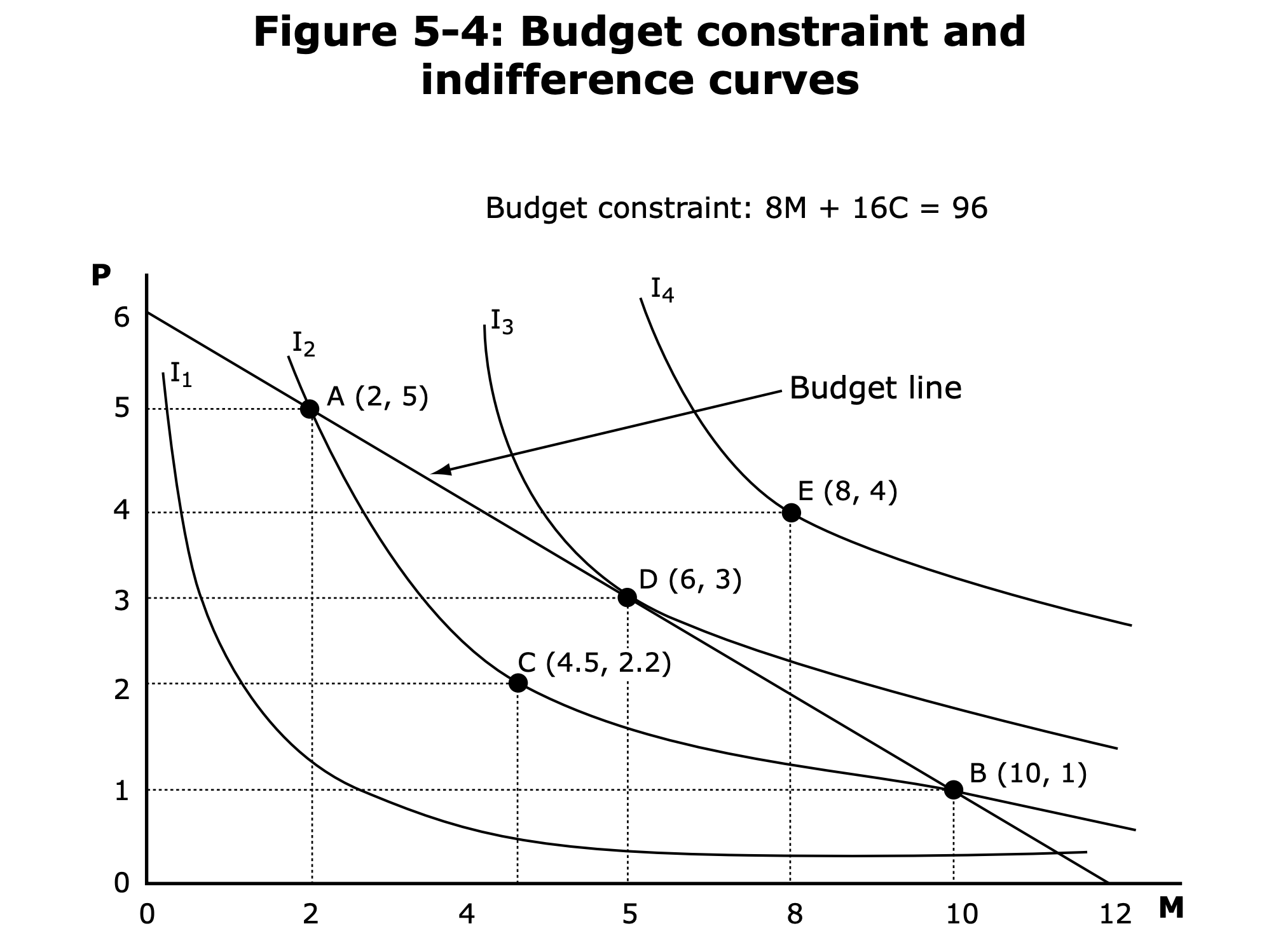

- Maximising Utility subject to Budget Constraint

- Maximising Utility is equivalent to choosing furthest out indifference curve on the budget line.

- Indifference curve will be tangent to the budget constraint!

- The slope of the indifference curve = slope of the budget constraint!

Marginal rate of substitution = Marginal rate of transformation!- (∂U/∂x_1) / (∂U/∂x_2) = - P_1 / P_2(Marginal) Benefit = (Marginal) Costs(∂U/∂x_1)/P_1 = (∂U/∂x_2)/P_2- If this is not true, we can shift optimal point towards where we have more benefit!

- Corner solutions possible where the slopes will not be equal!

- Government can affect consumption of goods through taxation.

- Or it can also use psychology to affect consumption. (Called Nudge in behavioural economics. Check out book called Nudge.)